No matter if you’re a financial advisor, investment issuer, or other economical Qualified, explore how SDIRAs may become a robust asset to expand your online business and achieve your Specialist plans.

In the event you’re looking for a ‘established and fail to remember’ investing method, an SDIRA likely isn’t the appropriate decision. Because you are in overall Manage around every single investment made, It truly is your choice to carry out your own personal homework. Bear in mind, SDIRA custodians are usually not fiduciaries and cannot make suggestions about investments.

As opposed to shares and bonds, alternative assets will often be more difficult to promote or can include stringent contracts and schedules.

And since some SDIRAs such as self-directed classic IRAs are subject matter to expected least distributions (RMDs), you’ll ought to program ahead to make sure that you have more than enough liquidity to satisfy the rules established through the IRS.

Being an Trader, nevertheless, your options are certainly not restricted to shares and bonds if you end up picking to self-immediate your retirement accounts. That’s why an SDIRA can remodel your portfolio.

Introducing hard cash straight to your account. Remember that contributions are subject to once-a-year IRA contribution boundaries set from the IRS.

Making by far the most of tax-advantaged accounts allows you to continue to keep additional of the money that you simply devote and gain. Dependant upon regardless of whether you choose a conventional self-directed IRA or perhaps a self-directed Roth IRA, you have got the likely for tax-totally free or tax-deferred expansion, provided certain disorders are fulfilled.

IRAs held at banking institutions and brokerage firms give restricted investment possibilities for their clients given that they would not have the expertise or infrastructure to administer alternative assets.

Set just, for those who’re searching for a tax efficient way to make a portfolio that’s additional personalized towards your passions and abilities, an SDIRA may very well be the answer.

An SDIRA custodian is different mainly because they have the right employees, skills, and potential to maintain custody in the alternative investments. Step one in opening a self-directed IRA is to locate a company that may be specialised in administering accounts for alternative investments.

Confined Liquidity: A lot of the alternative assets that could be held in an SDIRA, like real estate, non-public equity, or precious metals, is probably not quickly liquidated. This can be a difficulty if you must access resources speedily.

Higher investment solutions suggests you'll be able to diversify your portfolio further than shares, bonds, and mutual money and hedge your portfolio against sector fluctuations and volatility.

Opening an SDIRA can provide you with use of investments normally unavailable through a bank or brokerage agency. Below’s how to start:

Because of this, they have an inclination not to advertise self-directed IRAs, which supply the flexibility to take a position in a broader choice of assets.

A self-directed IRA is undoubtedly an very impressive investment automobile, but it really’s not for everyone. Since the expressing goes: with fantastic electricity will come terrific responsibility; and with the SDIRA, that couldn’t be additional legitimate. Keep reading to find out why an SDIRA may well, or may not, be in your case.

Buyer Assist: investigate this site Seek out a supplier that offers dedicated aid, together with use of well-informed specialists who can respond to questions on compliance and IRS principles.

Ease of Use and Know-how: A person-welcoming System with on line tools to track your investments, post files, and manage your account is essential.

Entrust can support you in acquiring alternative investments together with your retirement resources, and administer the obtaining and offering of assets that are generally unavailable by banking institutions and brokerage firms.

Criminals sometimes prey on SDIRA holders; encouraging them to open accounts for the objective of making fraudulent investments. They typically idiot investors by telling them that Should the investment is acknowledged by a self-directed IRA custodian, it needs to be genuine, which isn’t legitimate. Once more, Make sure you do complete due diligence on all investments you select.

Barret Oliver Then & Now!

Barret Oliver Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Amanda Bearse Then & Now!

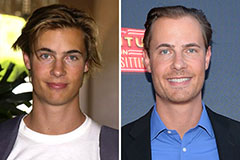

Amanda Bearse Then & Now! Erik von Detten Then & Now!

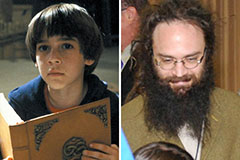

Erik von Detten Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now!